What you need to know about Washington’s biggest opportunity for financial stability

Fifty-seven percent of Americans—your friends, neighbors, and perhaps your own family—don’t have $500 in cash to cover an emergency or unplanned expense.

It’s a startling statistic, but one that probably isn’t surprising to the majority of working people. Between increasing medical care costs, surging housing prices, painfully high student loans, and creeping day-to-day expenses, working people across the country are feeling the squeeze of an economy that siphons wealth from the bottom and leaves financial stability an unattainable dream for so many.

Washington in particular puts working people and families at a disadvantage because our state has the most regressive tax code in the nation. Washington is one of only nine states that fails to tax capital gains – profits from the sale of luxury financial assets – giving a special deal to the wealthiest 1 percent while working families struggle to make ends meet. Our unbalanced tax code means that the richest among us pay only 3 percent of their income in taxes while the poorest families pay nearly 20 percent.

Thankfully, we can do something about this. Our new progressive majorities in Olympia give us our best opportunity in a decade to challenge this inequality. This legislative session, our representatives have the opportunity to give working people the lift we need by closing the tax break on capital gains and funding and expanding the Working Families Tax Credit.

Cash that can change fortunes

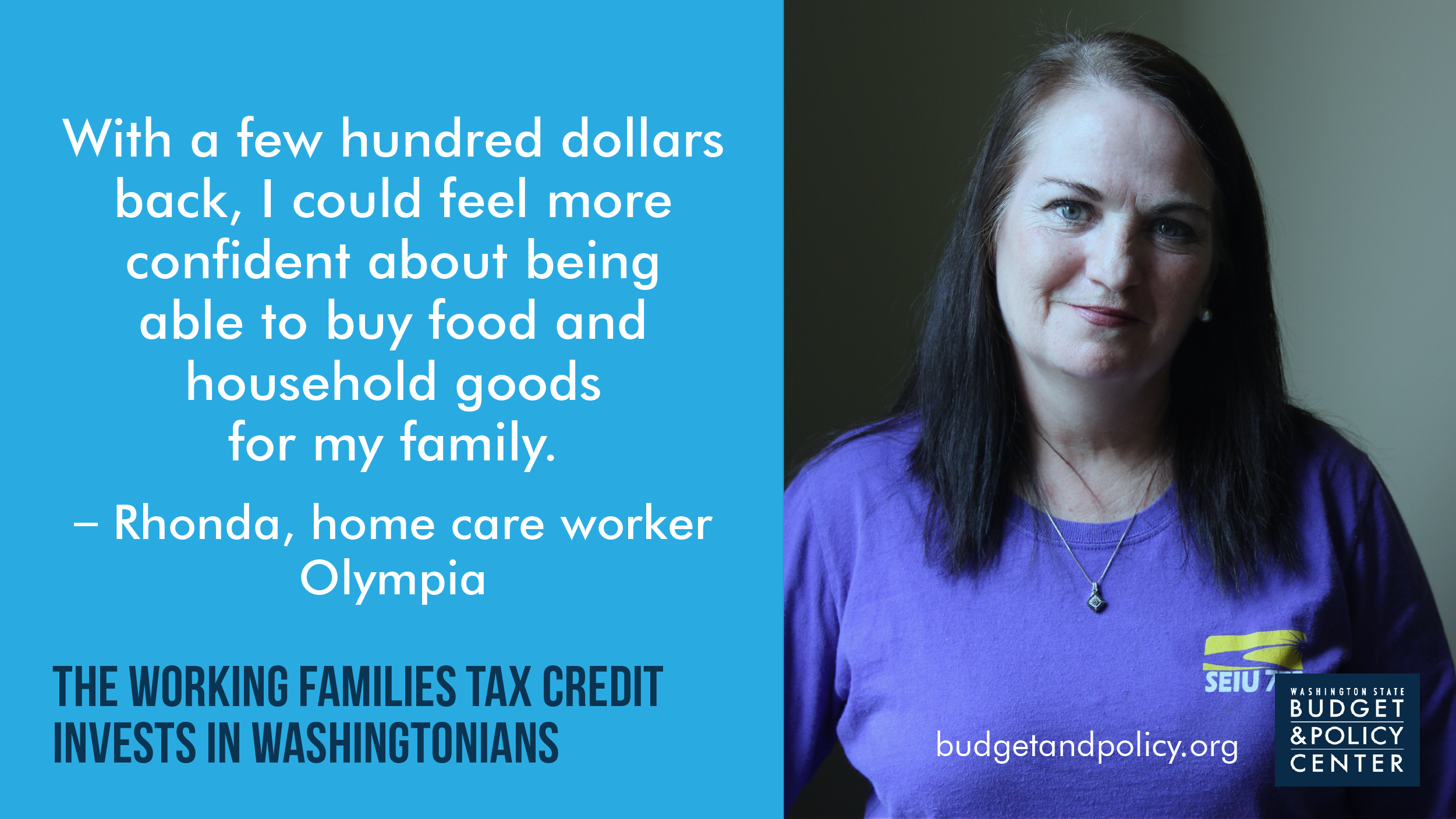

House Bill 1527, or the Working Families Tax Credit (WFTC), is Washington state’s equivalent to the federal Earned Income Tax Credit. Like its federal counterpart, the WFTC is a tax refund that puts cash back in the pockets of low- and middle-income working people. Whether it’s childcare, new glasses, student loans, medical needs, home repair, or a grocery bill, a flexible refund like the Working Families Tax Credit lets people use money how they need it today.

This small cash infusion, on average about $350 dollars and up to $970, could be a game changer for the nearly one million Washingtonians who would qualify. Research shows that returning funds to working people to spend on their most pressing needs is one of the most effective solutions to lift families out of poverty, and overall leads to healthier, happier communities. The bill is also aimed to assist those who need it most. Families with children receive extra help, which leads to better educational and health outcomes for children, and at a time when our nation’s racial wealth gap continues to widen, the WFTC helps families of color who more often struggle with financial stability.

Compared to cutting property taxes, the WFTC is far more effective, since wealthier people receive far more benefits from property tax cuts. Combined with a capital gains tax, the WFTC is the first critical step to righting Washington’s upside-down tax code and finally giving working people a break while getting the wealthiest to pay their fair share.

Next steps

On Thursday, February 7, a hearing is scheduled for this critical bill. If you’re able to come support working families in person, you can help Fuse and other community organizations fill the room with support for the WFTC! You can also take direct action online by calling your representatives at (833) 428-0840 and asking them to support the Working Families Tax Credit or by sending them a message. Every action you take today helps us build a bridge towards a better future for the working people of Washington.